Client Services

North AmericaClientSupport@svb.com1.800.774.7390 5:00 AM – 5:30 PM PT M-F |

United KingdomUKClientService@svb.com0800.023.1441 | +44.207.367.7881 8:00 AM – 1:30 AM GMT |

SVB PPP Care TeamSVBPPPCare@svb.com1.833.450.5444 5:00 AM – 5:30 PM PT M-F |

Contact the SVB PPP Care Team for all PPP application questions or view instructions here. |

Bill Pay Classic

| 1.866.321.6563 4:30 AM PT - 11:00 PM PT M-F |

Card Services

Cards Issued in the U.S.CardServices@svb.com1.866.553.3481 001.408.654.1039 (international) |

Cards Issued in the UK

0800.023.1062 |

Elite Cards1.866.940.5920 | 408.654.7720 |

|

Lost or Stolen Cards1.844.274.0771001.408.654.1039 (international) |

FX Trade Desk

SVB's FX Trade Desk is open from Sunday, 4:30 PM PT through Friday, 1:30 PM PT. During this time the desk is staffed 24 hours a day, excluding some holidays.

US Trade Desk1.888.313.4029IntFXT@svb.com 3:00 AM – 4:30 PM PT |

Asia Trade Desk+1.888.313.4029AsiaFXTrade@svb.com 4:30 PM – 3:OO AM PT |

SVB Asset Management1.866.719.9117SAMOperations@svb.com |

SVB Cash Sweep1.800.774.7390ClientService@svb.com |

More Support Contacts

- Payeezy

- Global Merchant Services

- What to Expect

- Being SVB Go Ready

- Paycheck Protection Program (PPP) Loan Forgiveness

- SVB Go Mobile

- Discover SVB Go

- UK Card Account Management

- UK Cardholders

- Cards - eCustomer Service

- Installing Flash

- SVB Innovator Toolkit

- Card Account Manager Individual Billed

- SVB Go Mobile

If we do not receive your application by your deferral period end date, monthly payments will be automatically debited from your account. As per SBA regulations, submitting your forgiveness application after the deferral period end date will not extend the payment deferral.

Paycheck Protection Program (PPP) Loan Forgiveness

Please review the sections below as you prepare to complete your PPP Loan Forgiveness Application:

- Determine If You Are Ready to Apply

- Apply Through SVB Online Banking

- PPP Loan Forgiveness Process - Start the Online Application

- Complete the SBA Form 3508

- Complete the SBA Form 3508EZ

- Complete the SBA Form 3508S

- Tracking the Status of Your Application

- Request to Repay Your PPP Loan

- Next Steps for Handling Your PPP Loan Balance

- Key Details About PPP Loan Forgiveness

- Review SBA's Rules on Changes in Ownership

Determine If You Are Ready to Apply

At this time, your covered period has ended and you are eligible to apply for forgiveness. If your organization used any of your PPP loan funds on eligible expenses, you may be able to get at least a portion of your PPP loan amount forgiven.

Please note, payroll is capped at the equivalent of $100K annual salary per FTE (for example, $15,385 for the 8-week period; $30,770 for 16-week period; and $46,154 for the 24-week period).

For Owner Employees there is a different payroll limit that is capped at the lower of: a) $20,833 or b) the 2.5-months of salary from your 2019 or 2020 payroll (whichever was used to calculate your loan). Employer contributions to expenses such as healthcare, retirement, state/local tax may be added in addition to the capped amount depending on the entity type of the organization.

Your Covered Period:

Your covered period is the span of time you chose to have available for spending your loan proceeds. The Small Business Administration (SBA) has allowed a time period from 8 weeks (56 days) to 24 weeks (168 days), beginning on the date you received your loan proceeds.

Expenses that Can Be Forgiven

- At least 60% of the PPP loan funds need to be used for payroll costs. Payroll costs include:

- Salaries, wages, tips or commissions (max. $100,000 per employee gross earnings), employee benefits (i.e. vacation/sick pay, healthcare/retirement benefits, life/vision/disability/dental insurance, state and local taxes).

- No more than 40% of the funds can be used for other non-payroll eligible expenses. These include:

- Mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations.

Supporting Documentation

For forgiveness, you will want to be sure you collect and retain the supporting documentation of eligible expenses. While we require various levels of documentation based on application type, you may be asked to provide documentation in the future by the SBA. We have developed a Documentation Guide to help you identify and gather the necessary documents and prepare for forgiveness.

A full list of the SBA documentation, submission and retention requirements can be found on the PPP Forgiveness Application (SBA Form 3508) instructions, the SBA Form 3508EZ Application instructions and the SBA Form 3508S Application instructions. In addition, each form’s application instructions list the documents that each borrower must maintain but is not required to submit. These documents may be requested if the SBA selects your application for a detailed review.

If your loan amount was less than or equal to $150,000, you may qualify for the SBA Form 3508S Application. This application does not require supporting documents to be provided during the loan forgiveness process. The Forgiveness Team will inform you in case we need any documents prior to submitting your application to the SBA.

We encourage our clients to provide Silicon Valley Bank with Professional Employer Organization (PEO) or payroll service company reports to evidence these items. In many cases, these providers are creating specialized reports that correspond to a client’s covered period.

Additional Information

If you would like to learn more about the program and frequently asked questions regarding different aspects of the PPP Loan Forgiveness, please visit our PPP Loan Forgiveness FAQ Page.

Apply Through SVB Online Banking

Determine which SBA form you will complete in SVB Online Banking. Click the link below to jump to steps on how to complete your application.

- SBA Form 3508S - Must be completed by borrowers with a loan in the amount of $150,000 or less.

- “EZ” Forgiveness Application form (SBA Form 3508EZ) – You have a loan amount greater than $150,000 and one of the following situations applies.

- Employer – You have not reduced the number of employees at all since January 1, 2020 AND have not reduced salary/wages more than 25% during the Covered Period for employees earning less than $100K in 2019.

- COVID-Impact – You are not able to operate at the same level of business due to COVID-related requirements AND you have not reduced salary/wages more than 25% during the Covered Period for employees earning less than $100K in 2019.

- SBA PPP Forgiveness application form (SBA Form 3508) – If you are not eligible to complete either of the other forms, you must complete this form.

Important: You cannot use one form to apply for forgiveness of both a First Draw PPP Loan and a Second Draw PPP Loan. For a Second Draw PPP Loan in excess of $150,000, you must submit a loan forgiveness application for your First Draw PPP Loan before or simultaneously with the loan forgiveness application for your Second Draw PPP Loan, even if the calculated amount of forgiveness on your First Draw PPP Loan is zero.

Access Your PPP Loan Forgiveness Application

The Primary Administrator for Borrowers with outstanding PPP loans are sent an email notification that the application is available.

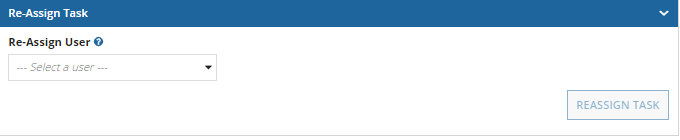

If someone other than the Primary Administrator should be completing the application, the Primary Administrator can select “Re-Assign Task” on the first page of the PPP Forgiveness Application.

Important: It is your obligation, as the borrower, to make sure you understand the SBA's rules and that your application is true, complete and correct, and complies with the SBA’s requirements for forgiveness. Loan forgiveness is not automatic and must be requested through Silicon Valley Bank. Other eligibility requirements may apply.

PPP Loan Forgiveness Process - Start the Online Application

Step 1: Access your PPP Loan Forgiveness Application

- Hover over your Name in the top-right corner of any SVB Online Banking screen and select My Tasks under 'My Profile'.

- Click the Task Number for the task titled ‘Forgiveness Status: Application Now Available’ to be taken to the PPP Loan Forgiveness Application.

- Optional: If you would like to reassign the application to a different User at your company, complete this step. Otherwise, move to the next step.

- If you do not see the user you would like to assign the application to for completion, update the user permissions to provide access to the PPP Loan.

- Review the disclaimer text and, if you agree, choose the check box to the left of the statement ‘I acknowledge and agree to the above’, and click Next.

- Review the information provided on the "Preparation" page to familiarize yourself with the SBA requirements and consolidate relevant documentations for your application, then click Next.

Important: If your loan amount is $150,000 or less, click on the following link to jump to the SBA Form 3508S guide.

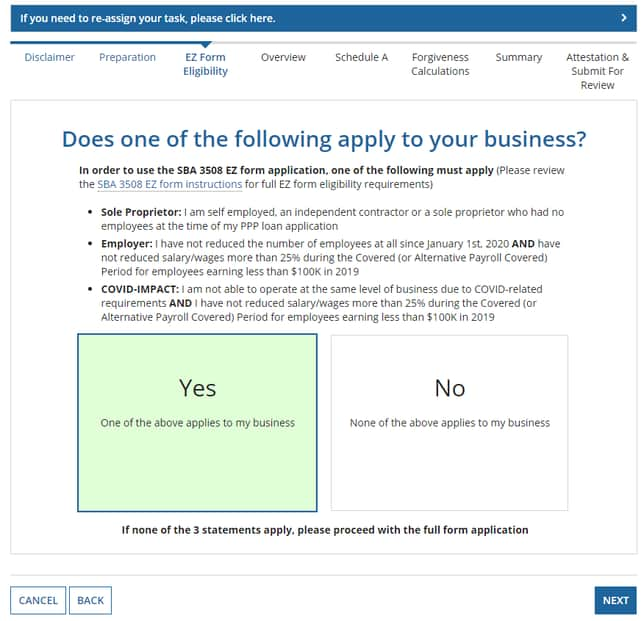

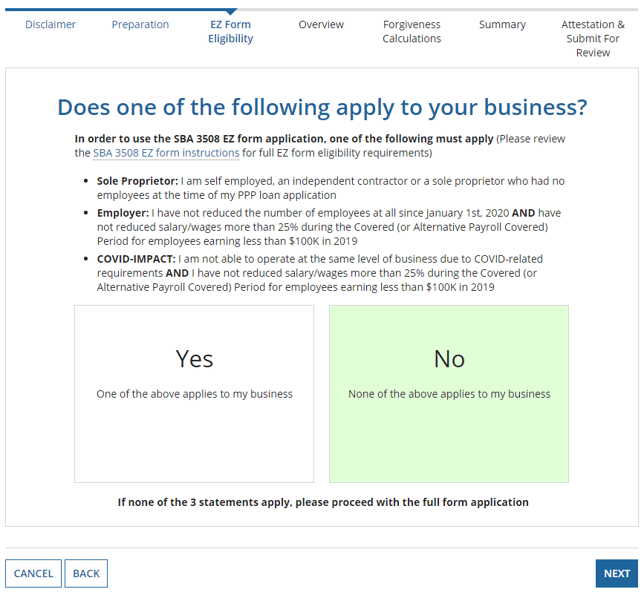

Step 2: Pre-Application Review

- Carefully read through all details to be sure you are adequately prepared to begin the application process and click Next.

- Answer the below bulleted questions and click the box with the appropriate yes or no response.

- Your choice will turn green.

- Click Next to be taken to the appropriate form.

If you meet the criteria to use the SBA Form 3508 EZ please skip to the SBA Form 3508 EZ application guide

Complete the SBA Form 3508

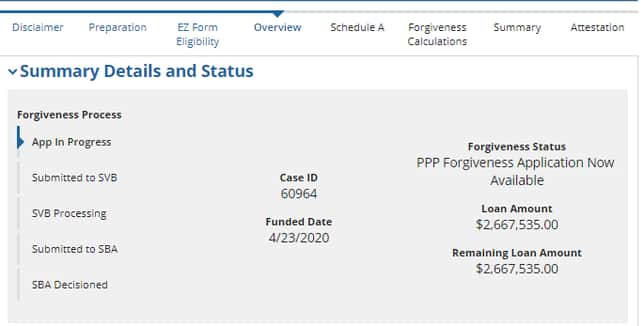

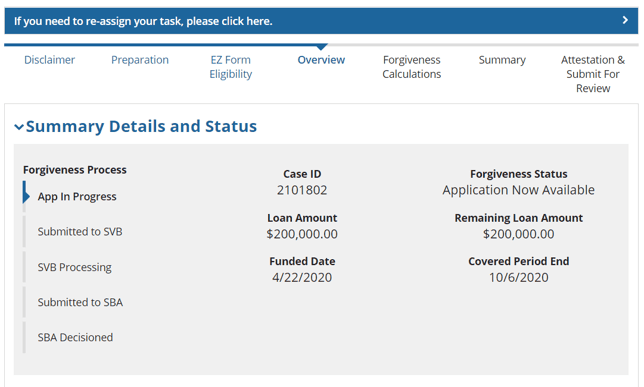

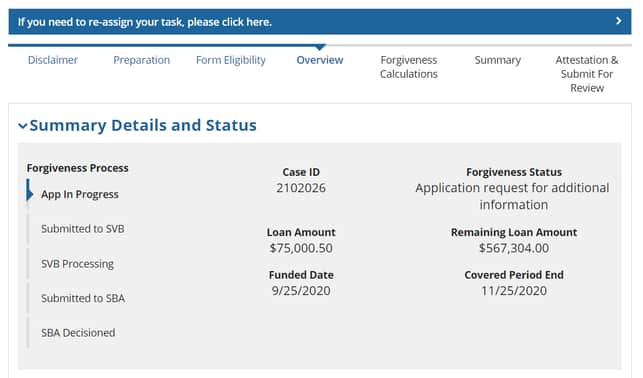

Summary Details & Status

Important: As you complete your application, remember to Save your progress as the application does not auto-save until you click Next.

- Application Progress - As you complete the application, across the top of the screen will be a status bar highlighting the progress you have made in completing the application.

- Forgiveness Process – At the top of the screen will be the Summary Details and Status box.

- Down the side, you will see the status of the forgiveness process.

- In the below screen you will see the application is in progress.

- For a list of Forgiveness Process statuses, click here.

- Loan Details – This box will also show key details regarding your PPP loan. This will perpetuate at the top of your screen as as a drop down option as you go through completing the application.

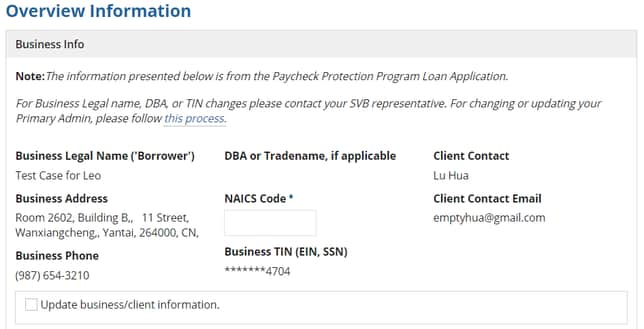

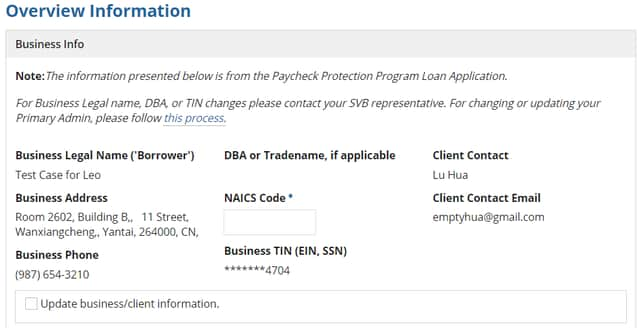

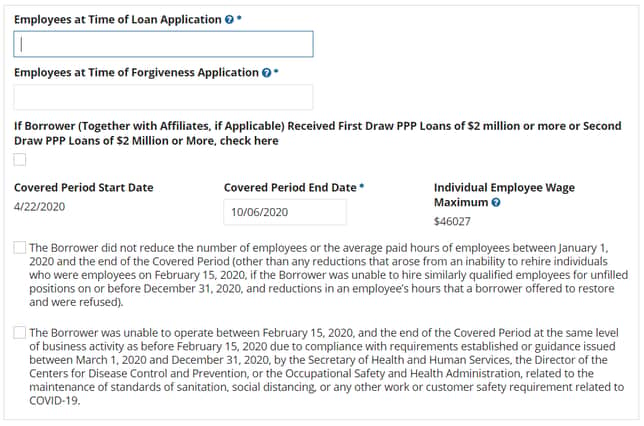

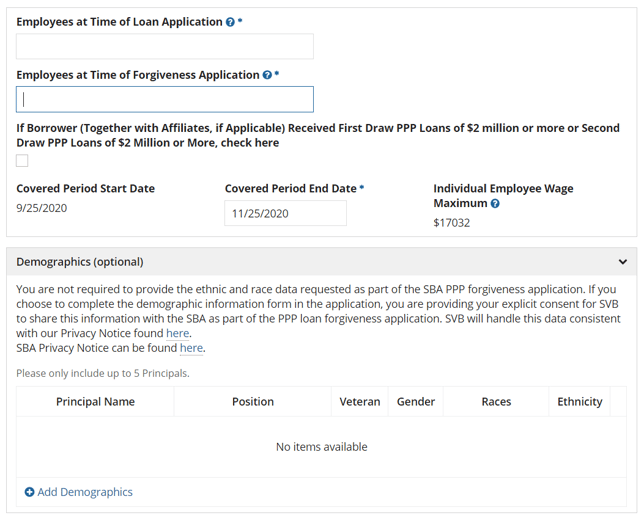

Step 1: Completing the Application - Overview Information

- When you begin to complete the application, be sure to review the Business Info for accuracy.

- Input NAICS Code in the blank box.

- To update Business Info – check the box next to ‘Update business/client information'.

- Only update fields where an update to the information is needed. Not all fields need to be completed.

- You can also click the check box on the screen if you would like to apply the update to all SVB records.

- Loan Info – Here you will see the details of your PPP loan number, loan amount, and disbursement date.

- Fill in key details for forgiveness:

- Employees at time of loan application

- Employees at time of forgiveness application

- Put a checkmark in the box If you (together with affiliates, if applicable) received First Draw PPP Loan exceeding $2 Millions or Second Draw PPP Loan exceeding $2 Millions

- Check that your Covered Period start date is correct

- Input date for the Covered Period end date (between 8 and 24 weeks from loan disbursement)

- Optional – Demographic Information: You can choose to include demographic information, which will be sent to the SBA. This information is not required.

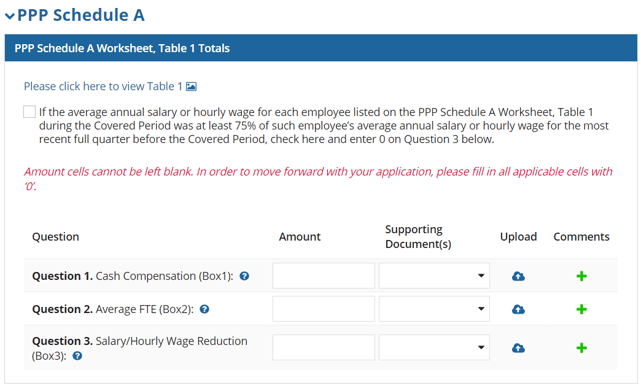

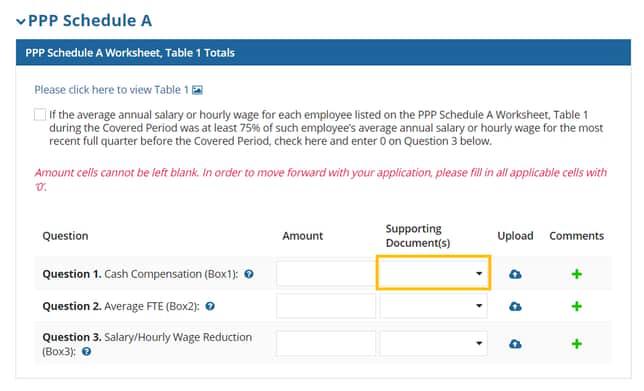

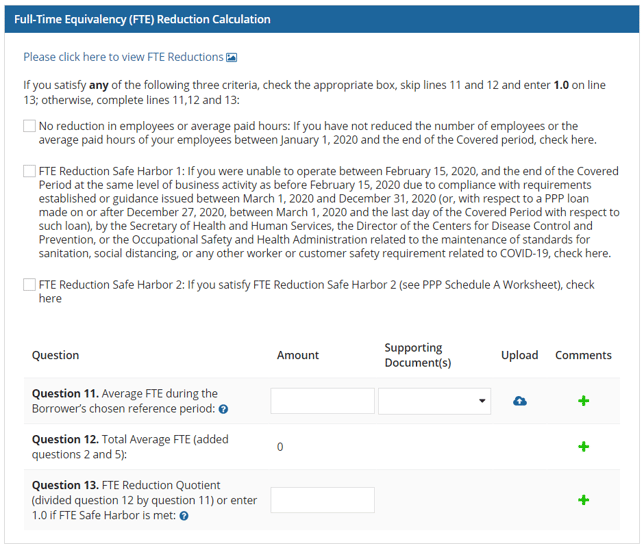

Step 2: Schedule A

To complete the various tables in the Schedule A worksheet, you will need to fill in the required information and complete the following steps within each line:

- Add the full amount / number for the respective line item.

- Add supporting documentations by clicking the Upload Icon. This will display the section where you can add the supporting documentation.

- Click the Upload button to open your files and double click on the supporting documentation.

- Enter documentation descriptor into the Description field.

- Notes section is optional.

- Save document.

- To attach corresponding document to support the particular line item, choose the uploaded document in the drop-down of Supporting Document(s) section.

- When you complete Schedule A, if you did have to reduce any employee count or cash compensation, you will see a reduction quotient auto summed on Line 13.

- Click Next.

Important: Review the Documentation Guide to help determine what supporting documentation will help expedite the review of your forgiveness application.

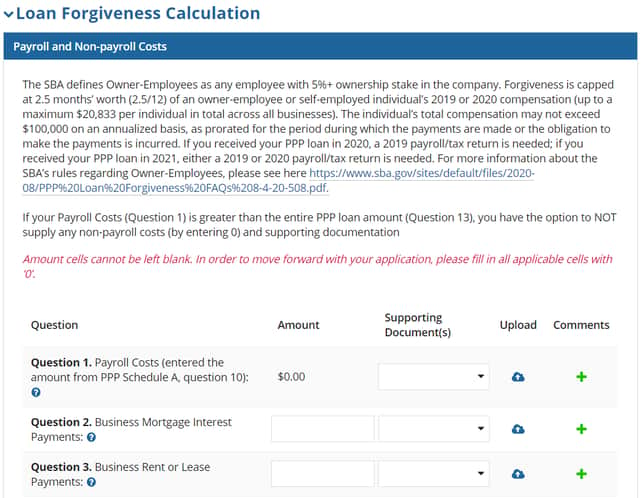

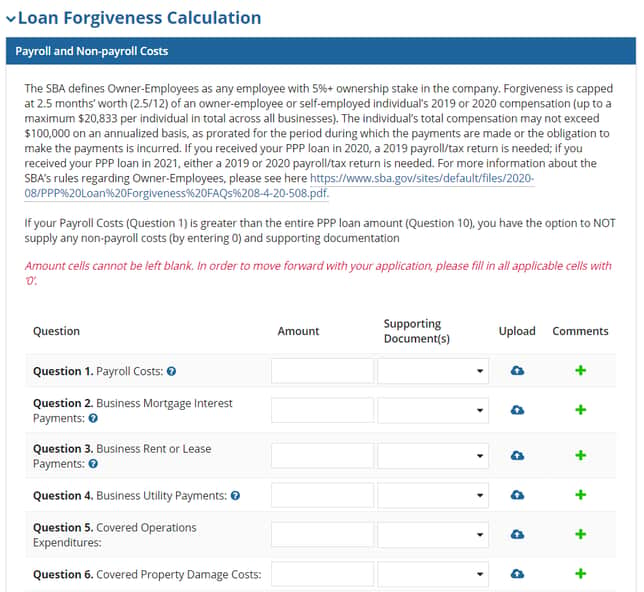

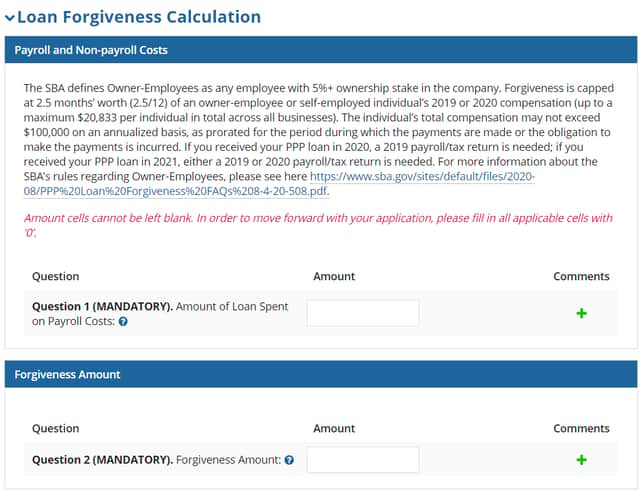

Step 3: Loan Forgiveness Calculation

Use this section to calculate your Loan Forgiveness amount. Line items that are not editable pull data points from the filled out Schedule A page.

Important: SBA Form 3508 includes four additional expense categories that were previously ineligible for Forgiveness calculations

- Add the full amount / number for the respective line item.

- Add supporting documentations by clicking the Upload Icon. This will display the section where you can add the supporting documentation.

- Click the Upload button to open your files and double click on the supporting documentation.

- Enter documentation descriptor into the Description field.

- Notes section is optional.

- Save document.

- To attach corresponding document to support the particular line item, choose the uploaded document in the drop-down of Supporting Document(s) section.

- Your eligible amount for forgiveness will display on Line 15.

- Click Next.

Step 4: Summary

This section allows you to complete a final inspection of your Loan Forgiveness application information, calculations and attached documents before finalizing the submission.

Please make sure to diligently check on the information that you have provided and line items you have filled out.

Once complete, please click on Next to proceed to the next section of the application

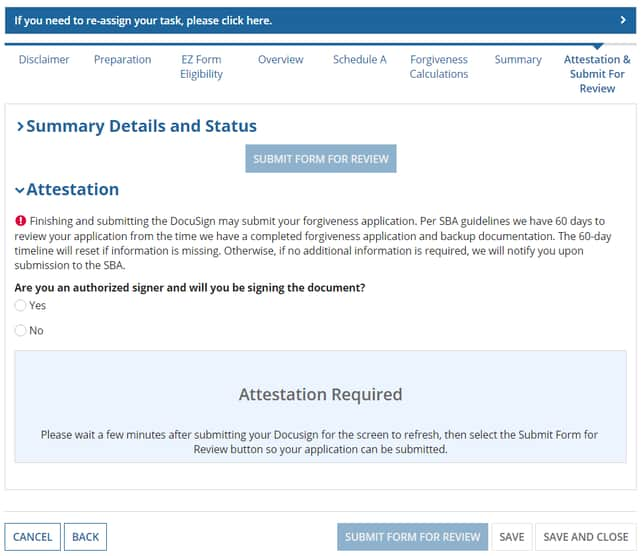

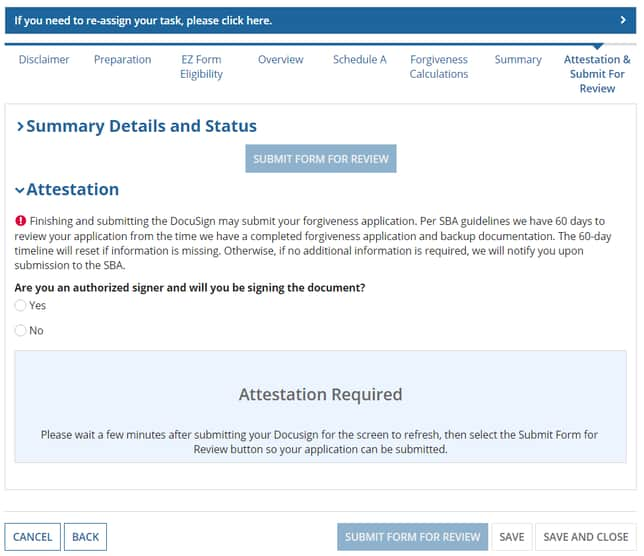

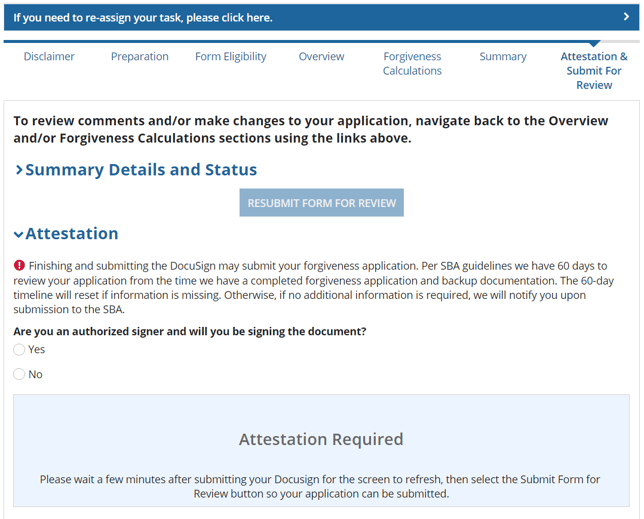

Step 5: Attestation & Submit for Review

This is the final step before you submit your application. Once you click on Submit Form For Review button, your application will be filed and ready to go through the review process

If you are the Authorized Signer who will be signing the application:

- Click the Yes radial button.

- Click Display DocuSign.

- Completed application will display within the screen. Review the application to ensure accuracy.

- If application is accurate, choose the Submit Form for Review.

If you are NOT the Authorized Signer who should be signing the application:

- Click the No radial button.

- Enter email address for Authorized Signer in both fields.

- Enter Authorized Signer’s name.

- Click Send to Signer.

SBA Form 3508 EZ Application Guide

If you meet the criteria to complete the SBA Form 3508 EZ select "Yes" on the EZ Form Eligibility screen and click Next.

Summary Details & Status

Important: As you complete your application, remember to Save your progress as the application does not auto-save until you click Next.

- Application Progress - As you complete the application, across the top of the screen will be a status bar highlighting the progress you have made in completing the application.

- Forgiveness Process – At the top of the screen will be the Summary Details and Status box.

- Down the side, you will see the status of the forgiveness process.

- In the below screen you will see the application is in progress.

- For a list of Forgiveness Process statuses, click here.

- Loan Details – This box will also show key details regarding your PPP loan. This will perpetuate at the top of your screen as as a drop down option as you go through completing the application.

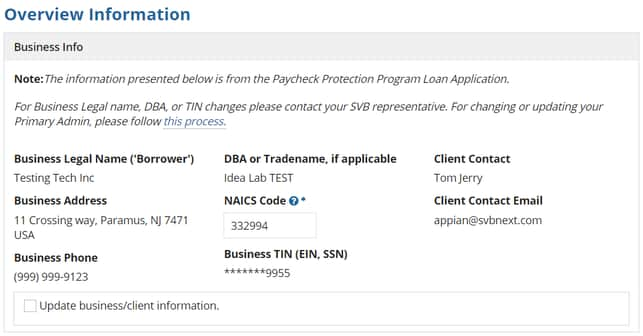

Step 1: Completing the Application - Overview Information

- When you begin to complete the application, be sure to review the Business Info for accuracy.

- Input NAICS Code in the empty box.

- To update Business Info – check the box next to ‘Update business/client information'.

- Only update fields where an update to the information is needed. Not all fields need to be completed.

- You can also click the check box on the screen if you would like to apply the update to all SVB records.

- Loan Info – Here you will see the details of your PPP loan number, loan amount, and disbursement date.

- Fill in key details for forgiveness:

- Employees at time of loan application

- Employees at time of forgiveness application

- Put a checkmark in the box If you (together with affiliates, if applicable) received First Draw PPP Loan exceeding $2 Millions or Second Draw PPP Loan exceeding $2 Millions

- Check that your Covered Period start date is correct

- Input date for the Covered Period end date

- Check the box if you did not reduce the number of employees or the average paid hours of employees between Jan 1, 2020 and the Covered Period

- Check the box if you were unable to operate between Feb 15, 2020 and the end of the Covered Period at the same level of business activity as before Feb 15, 2020

- Optional – Demographic Information: You can choose to include demographic information, which will be sent to the SBA. This information is not required.

Step 2: Forgiveness Calculations

Use this section to calculate your Loan Forgiveness amount. Line items that are not editable pull data from your existing PPP Loan profile or are auto-calculated within the page.

Important: SBA Form 3508EZ includes four additional expense categories that were previously ineligible for Forgiveness calculations

- Add the full amount / number for the respective line item.

- Add supporting documentations by clicking the Upload Icon. This will display the section where you can add the supporting documentation.

- Click the Upload button to open your files and double click on the supporting documentation.

- Enter documentation descriptor into the Description field.

- Notes section is optional.

- Save document.

- To attach corresponding document to support the particular line item, choose the uploaded document in the drop-down of Supporting Document(s) section.

- Your eligible amount for forgiveness will display on Line 12.

- Click Next.

Step 3: Summary

This section allows you to complete a final inspection of your Loan Forgiveness application information, calculations and attached documents before finalizing the submission.

Please make sure to diligently check on the information that you have provided and line items you have filled out.

Once complete, please click on Next to proceed to the next section of the application

Step 4: Attestation & Submit for Review

This is the final step before you submit your application. Once you click on Submit Form For Review button, your application will be filed and ready to go through the review process

If you are the Authorized Signer who will be signing the application:

- Click the Yes radial button.

- Click Display DocuSign.

- Completed application will display within the screen. Review the application to ensure accuracy.

- If application is accurate, choose the Submit Form for Review.

If you are NOT the Authorized Signer who should be signing the application:

- Click the No radial button.

- Enter email address for Authorized Signer in both fields.

- Enter Authorized Signer’s name.

- Click Send to Signer.

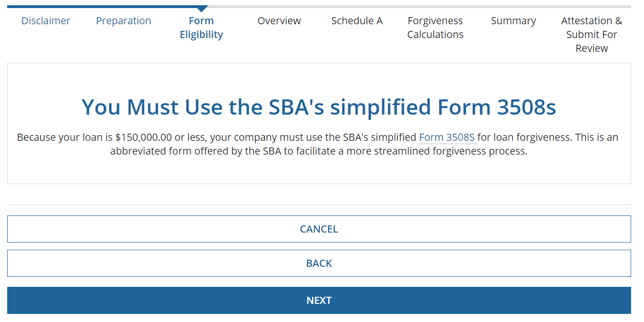

SBA Form 3508 S Application Guide

If your loan amount is $150,000 or less, you will be filling out your Forgiveness application using the SBA Form 3508 S. If you meet the criteria to complete the SBA Form 3508 S select "Next" on the S Form Eligibility screen.

Summary Details & Status

Important: As you complete your application, remember to Save your progress as the application does not auto-save until you click Next.

- Application Progress - As you complete the application, across the top of the screen will be a status bar highlighting the progress you have made in completing the application.

- Forgiveness Process – At the top of the screen will be the Summary Details and Status box.

- Down the side, you will see the status of the forgiveness process.

- In the below screen you will see the application is in progress.

- For a list of Forgiveness Process statuses, click here.

- Loan Details – This box will also show key details regarding your PPP loan. This will perpetuate at the top of your screen as as a drop down option as you go through completing the application.

Step 1: Completing the Application - Overview Information

- When you begin to complete the application, be sure to review the Business Info for accuracy.

- Input NAICS Code in the empty box.

- To update Business Info – check the box next to ‘Update business/client information'.

- Only update fields where an update to the information is needed. Not all fields need to be completed.

- You can also click the check box on the screen if you would like to apply the update to all SVB records.

- Loan Info – Here you will see the details of your PPP loan number, loan amount, and disbursement date.

- Fill in key details for forgiveness:

- Employees at time of loan application

- Employees at time of forgiveness application

- Put a checkmark in the box If you (together with affiliates, if applicable) received First Draw PPP Loan exceeding $2 Millions or Second Draw PPP Loan exceeding $2 Millions

- Check that your Covered Period start date is correct

- Input date for the Covered Period end date

- Optional – Demographic Information: You can choose to include demographic information, which will be sent to the SBA. This information is not required.

Step 2: Forgiveness Calculations

Due to the fact that you are eligible for the simplified SBA 3508S Form , you need to input only two entries for your forgiveness request and you do not need to provide supporting documentations:

- Add the Amount of Loan Spent on Payroll Costs in the cell on Line 1.

- Input Forgiveness Amount on Line 2.

- Click Next.

Step 3: Summary

This section allows you to complete a final inspection of your Loan Forgiveness application, calculations and attached documents (if you attached any) before finalizing the submission.

Please make sure to diligently check on the information that you have provided and line items you have filled out.

Once complete, please click on Next to proceed to the next section of the application

Step 4: Attestation & Submit for Review

This is the final step before you submit your application. Once you click on Submit Form For Review button, your application will be filed and ready to go through the review process

If you are the Authorized Signer who will be signing the application:

- Click the Yes radial button.

- Click Display DocuSign.

- Completed application will display within the screen. Review the application to ensure accuracy.

- If application is accurate, choose the Submit Form for Review.

If you are NOT the Authorized Signer who should be signing the application:

- Click the No radial button.

- Enter email address for Authorized Signer in both fields.

- Enter Authorized Signer’s name.

- Click Send to Signer.

Tracking the Status of Your Application

You can learn of current status of the forgiveness application in the following ways:

- Email – We will email you with the current status of your application when it moves to the next status.

- SVB Online Banking – Your task will remain in My Tasks and the status will display accordingly.

Click here for status definitions.

Request to Repay Your PPP Loan (pre-SBA Forgiveness Decision)

If you would like to repay a PPP loan (full or partial repayment) prior to receiving a forgiveness decision from the SBA, complete the required steps outlined below based on your circumstance.

Option 1 – Full Repayment Request of PPP Loan

To fully pay off your PPP loan, email the Repayment Request Language below, completed with the required information, to PPPServicing@SVB.com. Repayment of your PPP loan is final and may not be reversed.

REPAYMENT REQUEST LANGUAGE

“I, [AUTHORIZED SIGNER], hereby request to repay [LEGAL NAME OF BORROWER]’s loan under the SBA’s Paycheck Protection Program. The last four digits of our Taxpayer ID Number are [LAST 4 DIGITS OF TIN]. The exact amount of the loan repayment is [$XX,XXX.XX], plus any accrued interest. The last four digits of the Deposit Account from which to debit the repayment are [LAST 4 DIGITS OF DEPOSIT ACCOUNT].

I understand that my request to repay my the PPP loan is irrevocable and cannot be reversed or revoked, and that once my PPP loan is repaid, it cannot be forgiven by the SBA. I also acknowledge that because the PPP loan was funded, information regarding the loan may become public on the SBA website or otherwise under the Freedom of Information Act."

Thank you,

[ AUTHORIZED SIGNER]

Upon sending the above email message to the PPPServicing@SVB.com mailbox, we will work with you to complete the process.

Important:

- The email must come from the Authorized Signer citing the exact company name listed on the application.

- Until SVB receives the email with the above statement, your request to repay your PPP loan will not be deemed to have been received by SVB.

- We must receive this email in order to validate your information and process the loan repayment.

- Repayment of the loan is final and may not be revoked.

Option 2 – Partial Repayment Request

Pay off a portion of your PPP loan received from Silicon Valley Bank. Use the Partial Repayment Request Language below, filled in with the required information, and send an email to PPPServicing@SVB.com. Repayment of your PPP loan is final and may not be revoked.

PARTIAL REPAYMENT REQUEST LANGUAGE

“I, [AUTHORIZED SIGNER], hereby request to make a partial repayment of [LEGAL NAME OF BORROWER]’s loan under the SBA’s Paycheck Protection Program. The last four digits of our Taxpayer ID Number are [LAST 4 DIGITS OF TIN]. The exact amount of the loan repayment is [$XX,XXX.XX], plus any accrued interest. The last four digits of the Deposit Account from which to debit the repayment are [LAST 4 DIGITS OF DEPOSIT ACCOUNT].

I understand that this repayment of the PPP loan is irrevocable and cannot be undone. I also acknowledge that because the PPP loan was funded, information regarding the loan may become public on the SBA website or otherwise under the Freedom of Information Act."

Thank you,

[ AUTHORIZED SIGNER]

Important:

- The email must come from the Authorized Signer citing the exact company name listed on the application.

- Until SVB receives the email with the above statement, your request to repay your PPP loan will not be deemed to have been received by SVB.

- We must receive this email in order to validate your information and process the loan repayment.

- Repayment of the loan is final and may not be revoked.

Next Steps for Handling your PPP Loan Balance (post-SBA Forgiveness Decision)

Once the SBA has provided their forgiveness decision and payment, you may have a remaining balance on your loan.

Examples of where SVB is seeing this include:

- Borrowers that only applied for partial forgiveness, or

- Borrowers that have an EIDL Advance that was subtracted from the PPP forgiveness payment to SVB.

SVB is offering three options for repayment of this balance:

- One-Time Loan Payoff with SVB Deposit Account

- One-Time Loan Payoff with Escrow Account

- Set up of Monthly Auto-Debit

Option 1 – One-Time Loan Payoff Request with SVB Deposit Account

To fully pay off the remaining balance on your PPP loan, email the One-Time Loan Payoff Request with SVB Deposit Account language below, completed with the required information, to PPPServicing@SVB.com. The loan repayment amount below should reflect your current PPP loan principal balance, which can be viewed in SVB Online Banking – Account Summary – Loan Account. Repayment of your PPP loan is final and may not be reversed.

ONE-TIME LOAN PAYOFF REQUEST WITH SVB DEPOSIT ACCOUNT LANGUAGE

"I, [AUTHORIZED SIGNER], hereby request to fully repay the outstanding balance of [LEGAL NAME OF BORROWER]’s loan under the SBA’s Paycheck Protection Program, including accrued interest.

The last four digits of our Taxpayer ID Number are [LAST 4 DIGITS OF TIN].

The exact amount of the loan repayment is [$XXX,XXX.XX], plus any accrued interest.

The last four digits of the Deposit Account from which to debit the repayment are [LAST 4 DIGITS OF DEPOSIT ACCOUNT].

I understand that this amount represents the outstanding balance of the PPP loan after processing of the forgiveness application by the SBA. I understand that the PPP loan is not eligible for any further forgiveness."

Thank you,

[ AUTHORIZED SIGNER]

Option 2 – One-Time Loan Payoff Request with Escrow (for Change of Ownership Clients)

If you were going through a Change of Ownership and funded an Escrow account related to your PPP Loan, no additional action is required. We will use a portion of your Escrow account to pay-off the remaining balance for your PPP Loan and then we will release the remaining funds to you as described in your Escrow agreement.

Option 3 – Set up Monthly Recurring Payments for Remaining Unforgiven PPP Loan Balance via Auto-Debit

Auto-Debit from PPP Disbursement Account

To pay the remaining PPP loan balance on a monthly basis, SVB will set up a monthly auto-debit from the Direct Deposit Account into which the PPP funds were disbursed. No additional action is required for this option.

Payments will start the month after the SBA makes their forgiveness decision and will run until your PPP loan maturity date. The amortization payments are calculated so you will have a fixed monthly payment. The monthly payment amount and payment date will be available on your PPP Loan Statement (available at SVB Online Banking – Account Summary – Loan Account) 15 days prior to your payment due date.

Auto-Debit from a different account at Silicon Valley Bank

If you wish to arrange the auto-debit from a different account at Silicon Valley Bank on the remaining balance for your PPP loan, email the Auto-Debit Request Language below, completed with the required information, to PPPServicing@SVB.com.

AUTO-DEBIT REQUEST LANGUAGE

"I, [AUTHORIZED SIGNER], hereby request to set up monthly recurring payments via auto-debit for the payment of principal and interest of [LEGAL NAME OF BORROWER]’s loan under the SBA’s Paycheck Protection Program.

The last four digits of our Taxpayer ID Number are [LAST 4 DIGITS OF TIN].

The last four digits of the Deposit Account from which to debit the repayment are [LAST 4 DIGITS OF DEPOSIT ACCOUNT].

I understand that this payment will be applied to the outstanding balance of the PPP loan, after processing of the forgiveness application by the SBA. I understand that the PPP loan is not eligible for any further forgiveness."

Thank you,

[AUTHORIZED SIGNER]

Key SBA Details About PPP Loan Forgiveness

Important: It is your obligation, as the borrower, to make sure you understand the SBA's rules. Other eligibility requirements may apply.

Loan forgiveness is not automatic and must be requested through SVB.

Loan Forgiveness Timeline:

- The borrower has 8 to 24 weeks to use funds that were provided by the PPP loan in order for that portion to qualify for Forgiveness. This period is referred to as a Covered Period.

- Payments for the loan are deferred until the earlier of: Loan disbursements date + 24 weeks + 10 months OR when there is a Forgiveness decision made by the SBA.

- The Forgiveness process can take up to 150 days (the bank has up to 60 days to review/submit to the SBA and the SBA has 90 days to review/make decision)

Loan Forgiveness Eligibility Criteria:

- To be eligible for loan forgiveness, PPP loan proceeds must be used for specified purposes, and at least 60% must be used for payroll costs, as defined by the SBA.

- Payroll includes cash compensation, state/local taxes, employer contributions for healthcare and employer contributions for retirement plans.

- Forgivable cash compensations is capped at $100K/employee ($46,154 for a 24-week period)

- There are additional caps in place for owner-employees ($20,833 cash comp for a 24-week period + additional caps based on entity type)

- Not more than 40% of the loan forgiveness amount may be attributable for non-payroll costs. These costs can include:

- Mortgage interest and rental expenses

- specific utility bills (electricity, gas, water, telephone, transportation, or internet access).

- Additionally, you can also include operations expenses such as software, cloud computing, HR, accounting costs

- Property damage expenses from 2020 riots/looting.

- Supplier expenses and PPE.

- Please note, all of these expenses must be incurred or paid during the Covered Period.

- PPP borrowers must maintain their employee headcount and compensation levels during the 8-24 week Covered Period after loan disbursement or provide applicable safe harbor or exemption statement.

- If organization receiving PPP loan experiences reductions in salary/wage and/or FTE, commensurate reductions will be applied to the Forgiveness amount.

- Organizations will NOT be penalized if any reductions are due to employee-requested separation or employees fired for cause.

Loan Payment Deferral:

- Loan payments will be deferred for ten months following your Covered Period, but interest will continue to accrue, even if the loan is not forgiven, in part or in full. The borrower will be responsible under the loan for any amounts not forgiven.

- The SBA may limit the timeframe by which you will need to ask for forgiveness.

Review SBA's Rules on Changes in Ownership

On October 2, 2020, the SBA published an official change of ownership procedural notice detailing the requirements for PPP borrowers who wish to issue equity, sell assets or otherwise change their ownership. This procedural notice clearly outlines SBA requirements before a PPP borrower can proceed with their transaction. We know this has been a source of frustration for our clients and feel we now have the final guidance we have been seeking.

Under this new official guidance, PPP borrowers who wish to make any equity ownership change must notify SVB of all transactions. SVB has created a Change of Ownership scenario guide detailing the steps PPP borrowers should take in order to comply with the procedural notice.

To facilitate this approval, you will be required to complete this form and email it to SVBPPPCare@svb.com with the subject "Change in Ownership - <PPP Borrower Name>".

Please note that while SVB will submit consent requests that require SBA approval in a timely manner, the SBA may take up to 60 days to respond.

Need Additional Support? We're here for you.

SVB PPP Care Team

8:00 AM – 5:00 PM PT M-F

SVBPPPCare@svb.com

1.833.450.5444 (toll free)